Real PRIMA Certification PRM Designation Exam I 8006 Dumps Questions Released

Recently, real 8006 dumps questions have been released online to help candidates prepare for PRM Certification - Exam I: Finance Theory, Financial Instruments, Financial Markets – 2015 Edition certification exam. It is essential to prepare for PRM Designation 8006 exam with the actual and valuable 8006 exam dumps just about every 8006 exam question if you take Finance Theory, Financial Instruments and Markets certification exam for the initial time so real 8006 exam dumps is extremely great to ensure that you can pass in the first attempt.

What is PRIMA certification programs?

PRIMA certifications are great, which are designed to recognize your expertise in focused areas allowing you to demonstrate competence in the complex world of risk management. Candidates know that as a professional risk manager you need to stay informed in your industry and professional knowledge is changing at the speed of light. Your new knowledge is validated by passing an exam and receiving a certificate that is accredited by PRMIA, an independent industry association that monitors and upholds standards for the risk industry.

Currently, there are five categories of PRIMA certifications, inluding:

● Professional Risk Manager (PRM™)

● Associate PRM

● Operational Risk Manager (ORM) Certificate

● Credit and Counterparty Risk Manager (CCRM) Certificate

● PRMIA Market, Liquidity and Asset Management Risk Manager (MLARM) Certificate

Professional Risk Manager (PRM™)

The PRM Designation is a globally recognized, graduate-level risk management credential, which requires to complete four exams being taken in any order over a period of up to two years. Today's Risk Professionals are expected to know and understand industry best practices and be committed to using them. There is no better way for risk managers to show their commitment than by proving that they have the knowledge, skills, and qualifications to back their experience.

Associate Professional Risk Manager (Associate PRM)

The Associate PRM is a PRMIA certificate program intended for staff entering the risk management profession, or those who interface with risk management disciplines on a regular basis, such as auditing, accounting, legal, and systems personnel who want to understand fundamental risk management methods and practices.

Operational Risk Manager (ORM)

The PRIMA ORM Certificate is designed to deliver a deep, practical understanding of operational risk management frameworks and measurement methodologies in financial institutions. Successful candidates will be better prepared to implement meaningful risk assessment initiatives, produce useful risk management information and understand basic modeling techniques for operational risk measurement.

Credit and Counterparty Risk Manager (CCRM)

The CCRM Certificate is designed to deliver a deep, practical understanding of credit risk analysis frameworks and how to deploy them and act on them in practice in financial institutions. Successful candidates will be better prepared to implement meaningful risk assessment initiatives, produce useful risk management information, and understand the key modeling techniques for credit risk measurement.

PRMIA Market, Liquidity and Asset Management Risk Manager (MLARM)

PRIMA Certification MLARM Certificate is designed to deliver a deep, practical understanding of these areas of risk management, their frameworks, and various measurement methodologies in financial institutions. Successful candidates will be better prepared to implement the processes, procedures and policies around these areas, as well as gain a deep overview of the related tools and techniques.

What are the main exam topics in 8006 Exam I — Finance Theory, Financial Instruments and Markets exam?

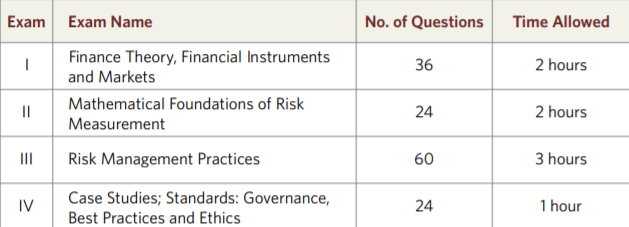

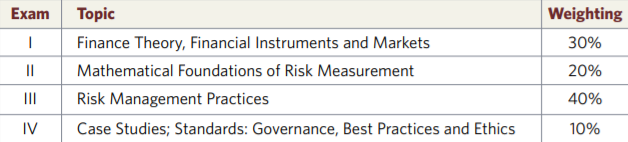

The four PRIMA PRM certification exams are hot listed:

8006 PRM Certification - Exam I: Finance Theory, Financial Instruments, Financial Markets – 2015 Edition

8007 Exam II: Mathematical Foundations of Risk Measurement - 2015 Edition

8008 Exam III: Risk Management Frameworks . Operational Risk . Credit Risk . Counterparty Risk . Market Risk . ALM . FTP - 2015 Edition

8009 Exam IV: Case Studies: Standards: Governance, Best Practices and Ethics - 2015 Edition

They are designed to measure the knowledge of professional risk managers and ensure they meet a specific performance standard in their profession. Individuals with the PRM designation have demonstrated their knowledge and understanding of:

● the classic finance theory underpinning risk management

● the foundations of risk measurement

● the foundation of option theory

● financial instruments and their associated risks and uses

● the daily form and function of trading markets

● risk management best practices

● lessons learned from failed systems and practices and major risk events

● best practices of governance, conduct and ethics

Exam I — Finance Theory, Financial Instruments and Markets 8006 Exam Topics

Finance Theory 36%

■ Risk and Risk Aversion

■ Portfolio Mathematics

■ Capital Allocation

■ The Capital Asset Pricing Model (CAPM) and Multifactor Models

■ Basics of Capital Structure

■ The Term Structure of Interest Rates

Financial Instruments 36%

(Descriptive and Pricing Knowledge)

■ General Characteristics of Bonds

■ The Analysis of Bonds

■ Forward and Futures

■ Contracts

■ Swaps

■ Options

■ Credit Derivatives

■ Caps, Floors and Swaptions

Financial Markets 28%

■ The Structure of Financial Markets

■ Money Markets

■ Bond Markets

■ Foreign Exchange Markets

■ Stock Markets

■ Derivatives Exchanges

■ The Structure of Commodities Markets

■ Energy Markets

How to get the PRIMA PRM Designation 8006 free dumps?

Real PRIMA Certification PRM Designation Exam I 8006 Dumps Questions Released at DumpsBase with real exam questions and answers ensure that you can pass 8006 exam. Most candidates want to check the PRIMA PRM Designation 8006 free dumps first. How to get? Here, we have some free demo questions for checking:

Calculate the number of S&P futures contracts to sell to hedge the market exposure of an equity portfolio value at $1m and with a of 1.5. The S&P is currently at 1000 and the contract multiplier is 250.

A. 4

B. 8

C. 6

D. 2

Answer: C

Calculate the fair no-arbitrage spot price of oil if the price of a one year forward is $75, the discrete one year interest rates are 6%, and annual storage costs are $4 per barrel paid at the end of the year.

A. $70.75

B. $74.53

C. $71

D. $66.98

Answer: D

Euro-dollar deposits refer to

A. A deposit denominated in the ECU

B. A US dollar deposit outside the US

C. A Euro deposit convertible into dollars upon maturity

D. A Euro deposit in the USA

Answer: B

If the 3 month interest rate is 5%, and the 6 month interest rate is 6%, what would be the contract rate applicable to a 3 x 6 FRA?

A. 6%

B. 6.9%

C. 5.5%

D. 5%

Answer: B

Which of the following statements is INCORRECT according to CAPM:

A. expected returns on an asset will equal the risk free rate plus a compensation for the additional risk measured by the beta of the asset

B. the return expected by investors for holding the risky asset is a function of the covariance of the risky asset to the market portfolio

C. securities with a higher standard deviation of returns will have a higher expected return

D. portfolios on the efficient frontier have different Sharpe ratios

Answer: C

A bank advertises its certificates of deposits as yielding a 5.2% annual effective rate.

What is the equivalent continuously compounded rate of return?

A. 4.82%

B. 5%

C. 5.07%

D. 5.20%

Answer: C

[According to the PRMIA study guide for Exam 1, Simple Exotics and Convertible Bonds have been excluded from the syllabus. You may choose to ignore this question. It appears here solely because the Handbook continues to have these chapters.]

What is the current conversion premium for a convertible bond where $100 in market value of the bond is convertible into two shares and the current share price is $50?

A. 0.5

B. 1

C. 0

D. None of the above

Answer: C

[According to the PRMIA study guide for Exam 1, Simple Exotics and Convertible Bonds have been excluded from the syllabus. You may choose to ignore this question. It appears here solely because the Handbook continues to have these chapters.]

Which of the following describes a 'quanto' instrument:

A. options on options

B. any two asset hybrid instrument

C. correlation products

D. any two asset instrument in which one asset is a foreign currency

Answer: D

A bullet bond refers to a bond:

A. that carries no coupon payments during its lifetime

B. that provides for fixed coupons and repayment of principal at maturity

C. that is issued by a sovereign

D. that provides for floating rate interest payments during its lifetime

Answer: B

The securities market line (SML) based upon the CAPM expresses the relationship between

A. asset beta and expected returns

B. asset standard deviation and expected returns

C. excess returns from the asset and its standard deviation

D. market returns and asset returns

Answer: A

Using covered interest parity, calculate the 3 month CAD/USD forward rate if the spot CAD/USD rate is 1.1239 and the three month interest rates on CAD and USD are 0.75% and 0.4% annually respectively.

A. 1.1249

B. 1.1229

C. 1.1278

D. 1.1200

Answer: A

A receiver option on a swap is a swaption that gives the buyer the right to:

A. swap two options between the two counterparties

B. receive the fixed rate and pay a variable rate

C. receive the swap spread in effect on a future date and pay a variable underlying rate

D. pay the fixed rate and receive a variable rate

Answer: B

[According to the PRMIA study guide for Exam 1, Simple Exotics and Convertible Bonds have been excluded from the syllabus. You may choose to ignore this question. It appears here solely because the Handbook continues to have these chapters.]

A company that uses physical commodities as an input into its manufacturing process wishes to use options to hedge against a rise in its raw material costs.

Which of the following options would be the most cost effective to use?

A. Writer-extendible options

B. Correlation options

C. Vanilla options

D. Average rate options

Answer: D

A company has a long term loan from a bank at a fixed rate of interest. It expects interest rates to go down.

Which of the following instruments can the company use to convert its fixed rate liability to a floating rate liability?

A. A fixed for floating interest rate swap

B. A currency swap

C. A forward rate agreement

D. Interest rate futures

Answer: A

A trader comes in to work and finds the following prices in relation to a stock: $100 spot, $10 for a call expiring in one year with a strike price of $100, and $10 for a put with the same expiry and strike. Interest rates are at 5% per year, and the stock does not pay any dividends.

What should the trader do?

A. Buy the call, buy the put and sell the stock

B. Buy the call, sell the put and sell the stock

C. Buy the put, sell the call and buy the stock

D. Do nothing

Answer: B